10 step martingale forex

These strategies are risky and long-run benefits are difficult to achieve. The Martingale strategy therefore aims to double the trade size after a loss in order to eventually recover once your trade does succeed.

The Hype Around Martingale Trading Strategy Forex Trading Blog Forex News Articles And Market Analysis Fxcc

Imagine you have 100 and you want to bet on a coin toss using the Martingale strategy.

. If the roulette hits black again then you bet 4 on red. Making Decent Deals Heres the situation. The Secret to Success.

Your long-term expected return is still exactly the same. This could be hedging algorithmic and breakout strategy. Risks when trading Martingale strategy.

20 points these are all scenarios we have when receive signals. Steps in the Trading System. When the Martingale Strategy is used in betting the gambler must double the bet when faced with a loss.

A Martingale forex trading strategy offers very limited benefits such as trading rules that are easy to define and program into an Expert Advisor or other mechanical trading system. Note that the risk-reward ratio is 11. You lose 20 and now youre down an additional 30 from your initial 100.

To understand the topic better consider a trade with two outcomes with equal probability Outcome 1 and Outcome 2. Yes there might be. Another reason for the popularity of the martingale strategy in forex is that unlike stocks there is a much lower chance of the currency value dropping all the way to zero.

20 points and SL. First you should have an original trading strategy. And the outcomes regarding profits and drawdowns appear statistically predictable.

You bet on heads the coin flips that way and you win 1 bringing your equityup to 11. Each time you are successful you continue to bet the same 1 until you lose. Why Martingale strategies are attractive to forex traders First under ideal conditions.

Ad 874 Proven Accuracy. Suppose i have a trading system that when gives a 11 riskreward signal can win at least 20 of the times for example. Second you should then conduct your analysis and identify potential entry and exit positions.

To the one and only transaction that can bring the expected profit. Do you think you are. Move the protective stop from order 1 by trailing etc.

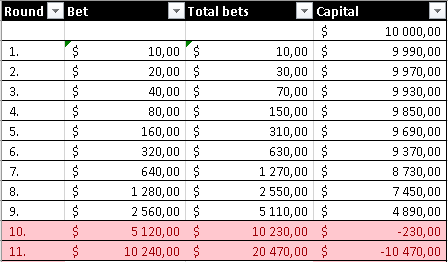

Loss - Loss - Loss - Win. Many times the next bet which the stop loss will prevent you from making would have been a winning bet. Since with martingale youre scaling on losses always expect large drawdowns on your account.

The system was initially developed to be applied to roulette. You had 10 winning trades and 15 losing trades. The best opportunity for this strategy is when one of your trades only has a 50 chance of succeeding which can be seen as having no expectation of winning or losing.

Why double when losing. In a Martingale system you take advantage of this truth by. Every trade has two potential outcomes profit and loss and both have equal probabilities of playing out.

Ad Sign up buy your first crypto in less than 3 mins. We have a profit-making system. It could be something like this.

It is a negative progression system that involves increasing your position size following a loss. This results in lowering of your average entry price. The idea behind the system is very simple.

1 ratio is much easier than if this proportion is 110 or 1. Next flip you call tails again but the coin lands on head again. Now imagine you enter a trade for 10 hoping to get the A outcome but instead you end up with B.

The idea of Martingale is not a trading logic but a math logic. Trade is taken easier now. FTX makes it easy to start investing.

However even so you still need to. The next flip is a loser and you bring your account equity back to 10. 5 10 20 40 80 160.

Martingale can not be used unless your mind is calmed down. After the start the trend. An automated forex trading system can close out these trades once the profit is realized or hold the currency pair in anticipation of greater profits.

The classic scenario for a Martingale progression is trying to trade an outcome where there is a 50 probability of it occurring. Trend Trading Major money is earned by trend trading. Okay dudes im gonna share a strategy.

Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years. This Anti-Martingale variation suggests that you stop betting after a streak of a predefined number of wins and then start a new cycle with a minimum bet amount. Simply put to succeed when the odds are distributed in a 1.

Weve decreased the minimum win rate. Your total capital is 315. Specifically it involves doubling up your trading size when you lose.

Experience the Power of Artificial Intelligence. So lets name the outcomes A and B. If the roulette doesnt hit red again then you should bet 8 16 and so on until you get a win.

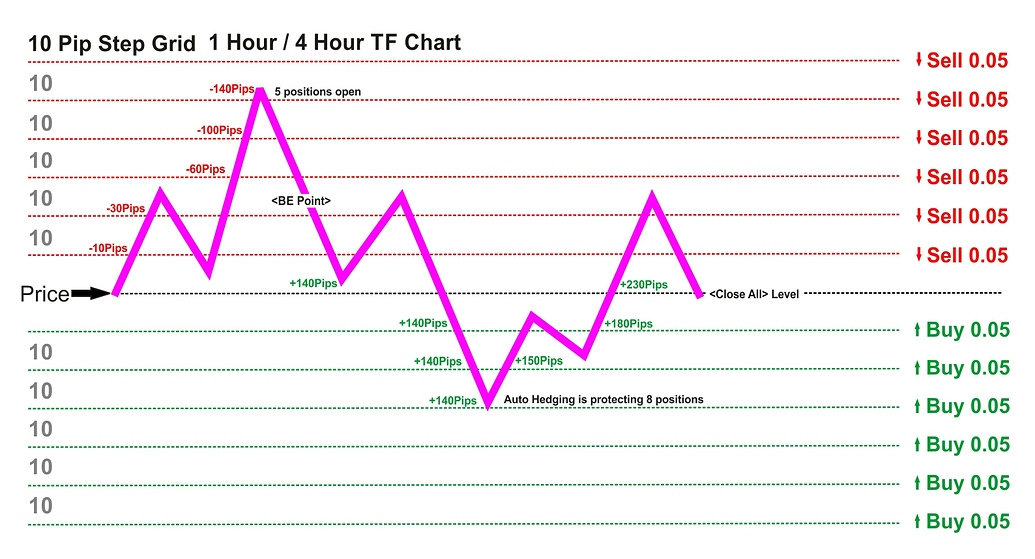

How to Trade Martingale. Start protective stop at x pips and open third order in the same direction with the same lotsize. Forex traders use Martingale cost-averaging strategies to average-down in losing trades.

Confidently buy and sell cryptocurrency on the FTX app built by traders for traders. And doubling on losses can be catastrophic when those trades do not turn around. Understanding the Martingale when there are Two Outcomes.

It is derived from the idea that when flipping a coin if you choose heads over and over you will eventually be right. Martingale is a cost-averaging strategy. We recommend that you use small lot sizes and low leverage when using the Martingale strategy.

Before the first flip you call tails and bet 10. To succeed in forex over the long term mitigating risks is one of the key rules. A Martingale forex strategy offers a risky way for traders to bet that that long-term statistics will revert to their means.

On the following bet y. Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker. It does this by doubling exposure on losing trades.

The coin lands on heads and you lose the 10. Heres how you can use the Martingale strategy in forex. Trading is not the place for emotions.

Loss - Loss - Win. 5 Forex Boosters Step 1. The important thing to know about Martingale is that it doesnt increase your odds of winning.

So your cycle will consist of up to 6 orders as follows. Our 40 Years Of Experience Speaks For Itself. If you lose double the investment and keep opening orders until you win.

Start protective stop at x pips and open secondary order in the same direction with the same lot size. Trader X decides to trade a fixed sum of 50 hoping for outcome 1. Though the coin may land on tails 2 or 3 or 10 times in a row it MUST eventually land on heads.

If you bet 1 on red and roulette hits black then you bet 2 on red. In this case each losing trade in this case should be considered as a step towards success. As well Martingale strategies dont rely on a traders ability to predict.

You trade with the Martingale method and start at 5. The 4-step Martingale will win roughly 15 out of 16 times 93 win rate. Assume that you have 10 to wager starting with the first wager of 1.

If you win on any order return to 5. Anyway a simple and effective variation of the Martingale is the 4-step Martingale in which we are allowed to double our entries only tree times. Strengths and advantages of Forex resulted in reduced win rate requirements.

Have a look at a BGPAUD chart.

Always In Profit Forex Hedged Martingale Strategy Part 3 Forex Forex System Forex Strategy

Super Martingale Ea Tested With Over 113 333 Profit Forex Trading System Automated Trading Forex

The Martingale Strategy In Forex Trading Market Business News

The Martingale Strategy In Forex Trading Market Business News

Is There Really A Special Forex Secrets In Forex Market Trading Psychology Babypips Com Forum

Martingale In Forex Trading Good Strategy Or Hazard Ftmo

Wd Binary Bot Smart Martingale System V4 1 Binary Com Bot Martingale Binary Forex Trading System

Martingale In Forex Trading Good Strategy Or Hazard Ftmo

Bots Software Chart Money Management

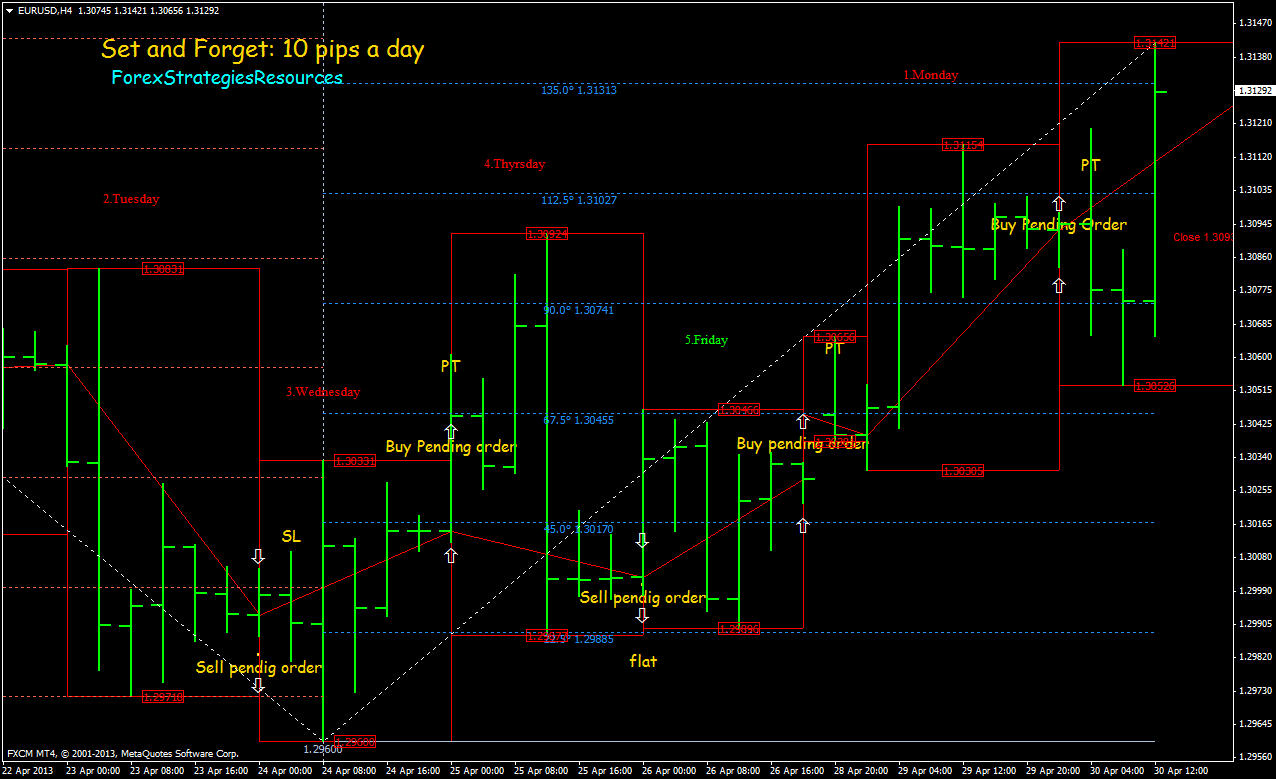

Rock Solid 10 Pip Day Strategy Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

10 Pips A Trade Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

98 Best Modified Martingale Strategy Rsi Moving Average Martingale Trading Strategy Youtube

Hourglass Free Free Download And Review Forex Software Forex Hourglass Absolute Value

Pin On Algo Algorithmic Ai Robot Trading Mt4 Expert Advisors Metatrader

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

Understanding Forex Risk Management

Divergencemacd Indicator Mq4 Forex Forex Trading Trading Charts

47 Set And Forget 10 Pips A Day Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Binary Options Stratagies Binary Options With Martingale Strategy Binary Options For Beginners Trade Ma Stock Options Trading Forex Trading Option Trading

Martingale Trading Strategy How To Use It Without Going Broke